Life is good. You are 25, in a good job, earning well, and partying hard. After spending on a great lifestyle, you still have some money left over. Its easy to let it lie in a savings account – and many do! Why is it necessary to do anything more? Well, if you are not in a job that offers a credible pension plan, you need to ensure that you have enough money to enjoy a good lifestyle when you decide to stop working – or at the age of 60 when many jobs force you to retire. This means that your money must work for you when you don’t work for money – the definition of investing.

Why does investing have to be in equities? Don’t other assets like real-estate, gold, and even debt offer opportunities? Sure, they do, and they often out-perform equity returns over years. However, equity represent a share in a business that can grow over time. This is rare, and valuable. No other asset generates income that increases over time.

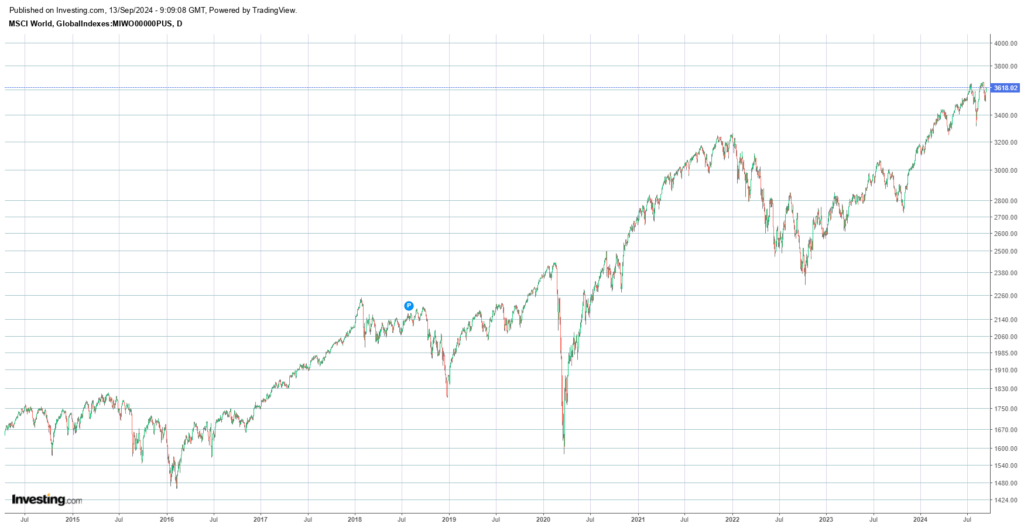

But the point of this note is not to discuss how to select stocks. It is to show that starting to invest early is essential to building a higher corpus. To illustrate the point, we choose the MSCI world index as the basis. Developed by Morgan Stanley Capital International (the MSCI bit), the world index represents the performance of 23 developed country markets. This is not the best performing index by a long stretch – many of the stocks in the index represent mature, slow-growth companies.

MSCI World Index – past 10 years

Over the past 10 years, the index has grown by a gentle 7.7% approximately. It has witnessed years of slow or no growth – starting in 2014, an investor would have seen zero returns in 2020 as a result of the market fall after covid-19 struck. The recovery was swift and returns have trended up since. Often, other assets will generate similar returns.

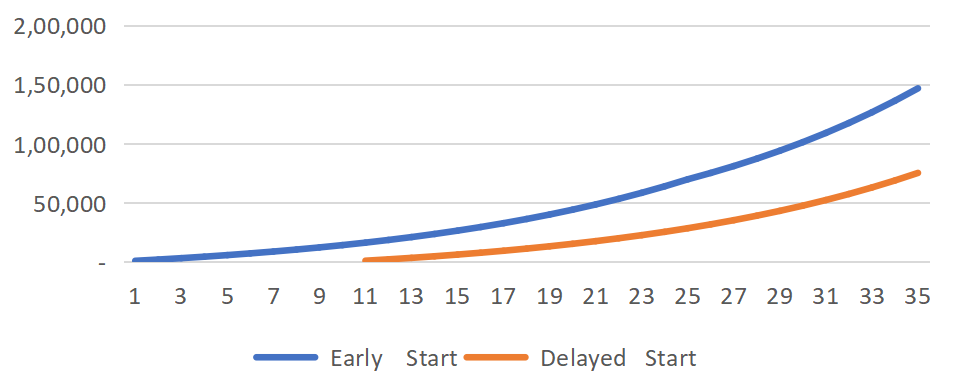

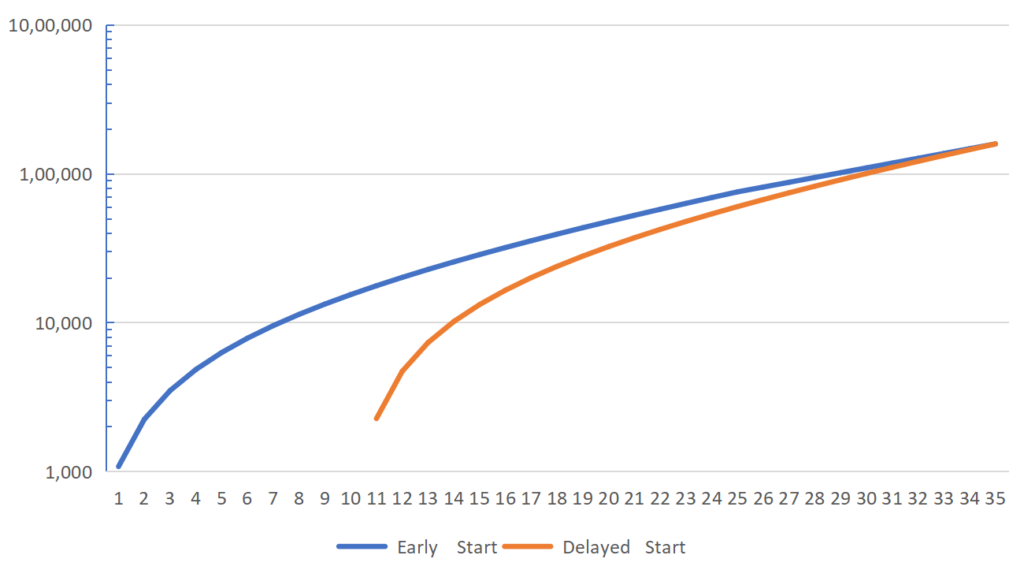

Let’s us assume that this is the rate that a long-term investor can get on a portfolio. Let’s further assume that you, as the investor, decide that you can invest 1000 units per year into a portfolio that generates this return and that you can do it every year for the next 25 years. Alternatively, you decide to delay the investment till say, a decade later and invest for 25 years (when you will be 60). Let’s examine the impact this would have on your retirement fund.

Delayed Start, Same Investment

| Return | Return | |||||||

| Age | Investment (per year) | Cumulative Investment | 7.70% | Age | Investment (per year) | Cumulative Investment | 7.70% | |

| 26 | 1,000 | 1,000 | 1,077 | 26 | ||||

| 27 | 1,000 | 2,000 | 2,237 | 27 | ||||

| 28 | 1,000 | 3,000 | 3,486 | 28 | ||||

| 29 | 1,000 | 4,000 | 4,832 | 29 | ||||

| 30 | 1,000 | 5,000 | 6,281 | 30 | ||||

| 31 | 1,000 | 6,000 | 7,841 | 31 | ||||

| 32 | 1,000 | 7,000 | 9,522 | 32 | ||||

| 33 | 1,000 | 8,000 | 11,332 | 33 | ||||

| 34 | 1,000 | 9,000 | 13,282 | 34 | ||||

| 35 | 1,000 | 10,000 | 15,382 | 35 | ||||

| 36 | 1,000 | 11,000 | 17,643 | 36 | 1,000 | 1,000 | 1,077 | |

| 37 | 1,000 | 12,000 | 20,078 | 37 | 1,000 | 2,000 | 2,237 | |

| 38 | 1,000 | 13,000 | 22,701 | 38 | 1,000 | 3,000 | 3,486 | |

| 39 | 1,000 | 14,000 | 25,526 | 39 | 1,000 | 4,000 | 4,832 | |

| 40 | 1,000 | 15,000 | 28,569 | 40 | 1,000 | 5,000 | 6,281 | |

| 41 | 1,000 | 16,000 | 31,846 | 41 | 1,000 | 6,000 | 7,841 | |

| 42 | 1,000 | 17,000 | 35,375 | 42 | 1,000 | 7,000 | 9,522 | |

| 43 | 1,000 | 18,000 | 39,176 | 43 | 1,000 | 8,000 | 11,332 | |

| 44 | 1,000 | 19,000 | 43,269 | 44 | 1,000 | 9,000 | 13,282 | |

| 45 | 1,000 | 20,000 | 47,678 | 45 | 1,000 | 10,000 | 15,382 | |

| 46 | 1,000 | 21,000 | 52,426 | 46 | 1,000 | 11,000 | 17,643 | |

| 47 | 1,000 | 22,000 | 57,540 | 47 | 1,000 | 12,000 | 20,078 | |

| 48 | 1,000 | 23,000 | 63,048 | 48 | 1,000 | 13,000 | 22,701 | |

| 49 | 1,000 | 24,000 | 68,979 | 49 | 1,000 | 14,000 | 25,526 | |

| 50 | 1,000 | 25,000 | 75,368 | 50 | 1,000 | 15,000 | 28,569 | |

| 51 | 25,000 | 81,171 | 51 | 1,000 | 16,000 | 31,846 | ||

| 52 | 25,000 | 87,421 | 52 | 1,000 | 17,000 | 35,375 | ||

| 53 | 25,000 | 94,153 | 53 | 1,000 | 18,000 | 39,176 | ||

| 54 | 25,000 | 1,01,402 | 54 | 1,000 | 19,000 | 43,269 | ||

| 55 | 25,000 | 1,09,210 | 55 | 1,000 | 20,000 | 47,678 | ||

| 56 | 25,000 | 1,17,620 | 56 | 1,000 | 21,000 | 52,426 | ||

| 57 | 25,000 | 1,26,676 | 57 | 1,000 | 22,000 | 57,540 | ||

| 58 | 25,000 | 1,36,430 | 58 | 1,000 | 23,000 | 63,048 | ||

| 59 | 25,000 | 1,46,935 | 59 | 1,000 | 24,000 | 68,979 | ||

| 60 | 25,000 | 1,58,250 | 60 | 1,000 | 25,000 | 75,368 |

The early start allows the investment to compound over the next 35 years, while the later start allows compounding for 25 years. Consequently, even though the investment made is the same – 25000 units, the accumulated value of the fund is more than twice in the first case.

Starting late by 10 periods needs an investment of 2.1x to

equal the same corpus

To generate the same corpus at the end of the period requires an investment that is 2.1x the investment required when you start early.

Keep in mind that typically, as income increases, it should be possible to increase the investment amount every year. Start early, invest regularly and in a meaningful quantum. That is the way to build a corpus that allows you free up your most valuable resource – your time on this planet – to do what you want to.