An equal weight index – implications for investors

On 31 May 2024, the NSE announced the launch of the Nifty500 Equal Weight Index. The index has its base date as 1st April 2005. The index starts with a value of 1000 on that day. Index values are then computed daily.

To compute the daily value of the index, it is assumed that each stock making up the index has an equal weight in the index. Assume that Rs 1 lakh has been invested on the first day. Since there are 500 stocks to invest in, each stock gets an investment of Rs 200/- (0.2% of the portfolio value). The value of the portfolio, scaled to a starting value of 1000, is the value of the index on subsequent days. As the stock prices change, the weightage of each stock in the basket will change. To ensure that the index remains “equal weight”, it has to be re-balanced. This is done every quarter. After every re-balancing, the index weights will again be equal.

Market-capitalization weighted versus equal-weighted indices

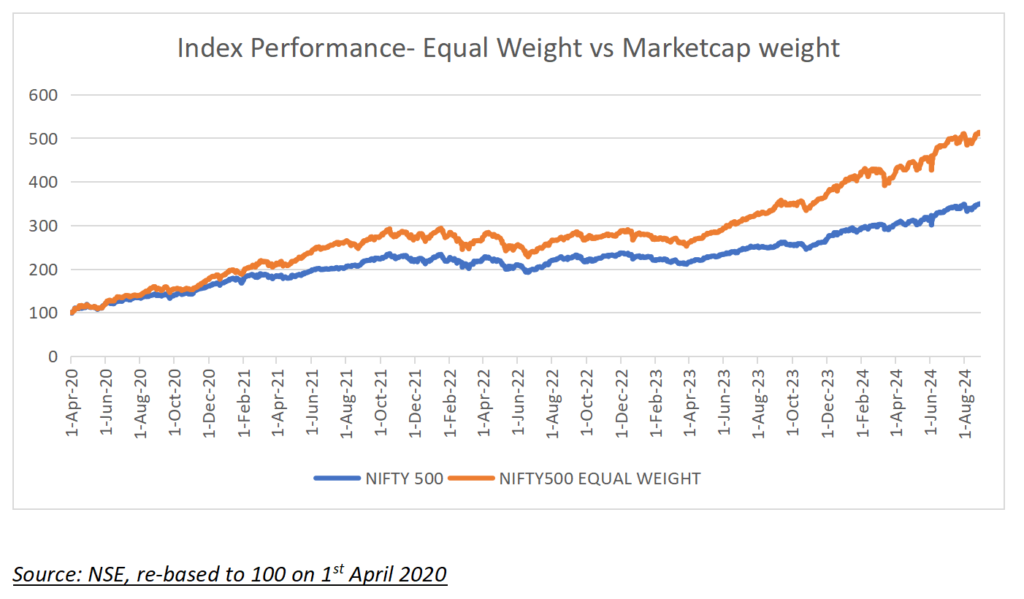

The NSE500 index is a market capitalization-based index – as are most popular indices like Nift50 and Sensex. These indices have their portfolio stocks “invested” in proportion to the market capitalization of the company. Larger companies dominate the performance of these indices. Equal-weight index performance on the other hand, will reflect the performance of smaller companies.

SEBI has defined large-cap as the top 100 companies by market capitalization. The next 150 companies by size make up the mid-cap universe. Everything else is considered small-cap. This means the NSE500 index comprises 100 large-cap, 150 mid-cap and 250 small-cap companies. If equally weighted, the index will be 50% invested in small-cap, 30% in mid-cap and only 20% in large-cap.

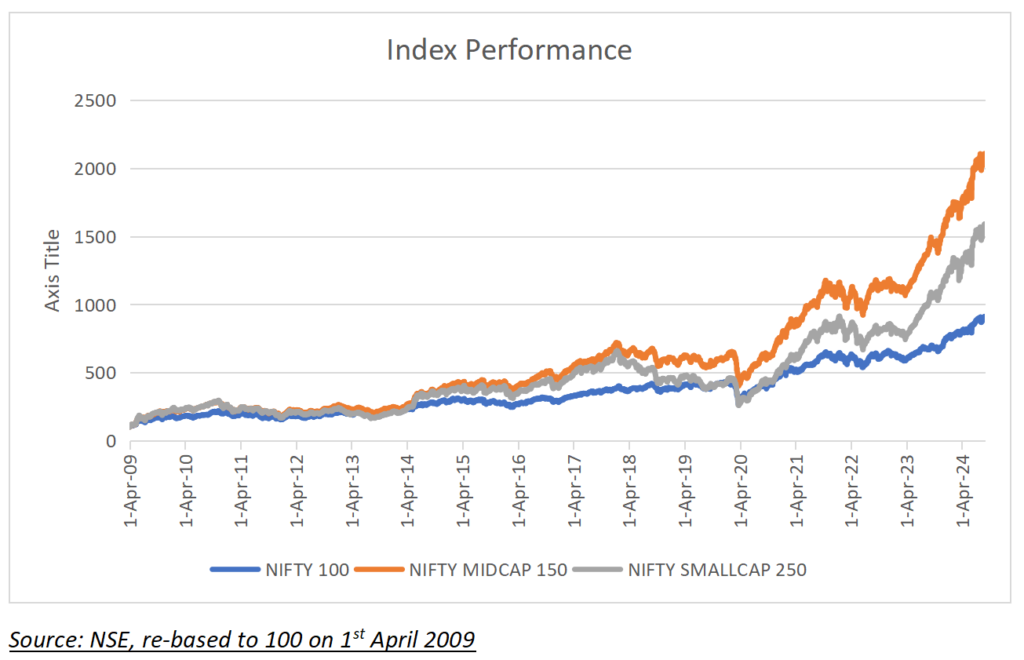

Index performance

The graph above shows the performance of the large, mid and small-cap indices for the past 15 years. As is apparent, the small-cap index has outperformed the mid-cap index which in turn has outperformed the large-cap index. These indices are not equal-weighted. The performance difference between large, mid and small-cap indices would be more glaring if an equal-weight index was used. It is not surprising that the equal-weight Nifty500 index has outperformed the market capitalization-based Nifty500 index – see the graph below.

Is small-cap the best bet?

If true, why should one not invest only in small-cap companies/funds/indices? As is often the case, it’s important to examine the path travelled.

The table above shows the annual performance of the indices broken up into 5-year periods. Over the first 5-year period under consideration, the performance of large and small-cap was almost the same with the mid-cap underperforming. In the second five-year period, the mid-cap out-performed. By 2020, small-cap had underperformed over 11-years. An investor in a predominantly small-cap portfolio on 1st April 2009, would have done worse than someone who invested in Nifty100 till 1 April 2011. Additionally, the volatility experienced would have been almost 70% higher.

Markets tend to move in cycles. Not surprisingly, after 11 years of underperformance, the small-cap index has done exceedingly well over the past four years. How long will this continue is difficult to estimate. The best outperformance is likely behind us, and the continued outperformance of smaller companies versus mid-sized or larger companies is unlikely to be sustained over the next many years.

Nippon AMC launches the first Nifty500 equal-weight index fund

Given this backdrop, an index fund mirroring the Nifty500 equal weight index seems rather late in the cycle. To be fair, the fund could be launched only once the index was created, which, as mentioned earlier, was just 3 months back. Retail investors (and now increasingly, institutional investors too) are influenced by momentum and near-term performance tends to dominate investment decisions. From a marketing perspective, the fund is well-timed. Performance of the underlying index has been strong and investors are particularly bullish on prospects of small companies – witness the performance of companies listing on the SME exchange. In this context, the fund will likely raise sizeable funds. Investors should keep their risk profile in mind while investing.